Today the European Commission has announced a raft of proposed reforms to the VATMOSS system, the e-commerce reform meant to target tax-dodging multinationals which instead had a devastating effect on SMEs, microbusinesses, and the digital industries.

It’s just over two years since that awful hashtag entered our lives and our businesses. Thousands upon thousands of words, hundreds of blog posts, and dozens of in-person meetings have taken place since then to try to get some changes made to this awful situation we never asked for. And now here they are.

We simply cannot thank the EU VAT Action campaign enough. These unpaid volunteers have lobbied for these changes on their own time, often at the cost of their own businesses and well-being.

Praising the work of the EU VAT Action campaign comes in the context of other groups and individuals who feigned an interest in helping, but were only ever in it for themselves chasing glory, PR, or their own political agendas. They contributed nothing. They know who they are.

Thresholds

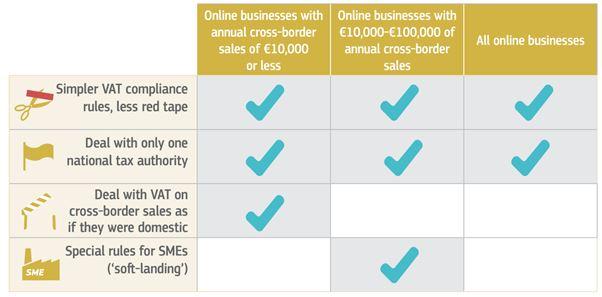

- There will be a threshold of €10,000 in online sales per annum before cross-border taxation rules apply. Businesses trading under that threshold will be able to apply domestic VAT rules.

- SMEs which make less than €100,000 in cross-border sales in e-services per annum will no longer be required to provide two pieces of evidence to prove the place of supply. The EC now says that one piece of evidence will suffice for traders of e-services.

We knew there would be some contention over what the proposed threshold would be. In their press release today, the EC has said:

“The Commission has sought to strike the right balance between reducing burdens for small business while ensuring that the threshold did not create distortions to the Single Market arising from differences in VAT rates. A threshold that was set too high could also have a distortive effect. Setting the threshold at €10 000 will give a boost to 430 000 businesses across the EU representing 97% of all micro-businesses trading cross-border. At the same time, 6 500 of the smallest companies selling e-services through the One Stop Shop system will be relieved from VAT obligations in other Member States.”

The taxman

- Microbusinesses will be allowed to use domestic VAT rules on invoicing requirements and record keeping. The silly requirement to retain all MOSS-applicable sales records and customer data for 10 years is on the way out.

- The first point of contact for queries will always be the tax administration where the seller is located. Sellers will no longer be audited by member states where they have made sales. This presumably means no more idiotic letters from Luxembourg over 5p discrepancies.

Expansion

MOSS – or rather, the application of VAT based on the place of supply rather than the place of sale – is being extended to cross-border sales of physical goods, as was intended from day one.

When will these proposals take effect?

We are not out of the woods yet. The proposed thresholds may be applied in 2018 on e‑services, and 2021 for online goods. Until then, you are obliged to carry on collecting the multiple data points to determine the place of supply.

The fine print

The announcement was accompanied by four legal documents which form the actual proposal, including the impact assessments. Never skip these documents. It’s where the really fascinating details are hidden.

A few items of note within them:

-

The introduction of the €10k threshold is anticipated to take 6,500 businesses out of the MOSS system, leading to a potential cost saving of €13 million. The threshold is also anticipated to benefit 430,000 businesses across Europe.

-

The €100k threshold before the requirement to supply two pieces of evidence kicks in is anticipated to benefit 1000 businesses.

- The €10k threshold will be optional. Businesses which suspect their sales may go above that in any given year will still be permitted to participate in the system while still under the threshold.

- The 10 year record retention period has been acknowledged as one which “largely exceeds the record keeping requirements of most Member States.”

- In response to feedback that it is very difficult for sellers to collect all the data they need within filing deadlines, the deadline may be extended from 20 to 30 days following the end of the tax period.

- The EC also wants sellers to be allowed to correct previous VAT returns “in a subsequent return instead of in the returns of the tax periods to which the corrections relate.”

- The EC mulled over six different policy options with various combinations of thresholds and simplifications. Each one was explored in detail. It almost feels like they were sent back to their rooms with a lot of homework.

- 95% of all reported issues with MOSS came from the UK.

- The average MOSS compliance cost for European businesses is €2,172.

- Germany and the UK hold 43% of all MOSS registrations across Europe.

- Way more interesting: Luxembourg submits 55% of all MOSS revenues, and Ireland 15%. The two countries with the most “tax issues” (ahem).

- 0.1% of all MOSS revenue has come from returns with a declared turnover of under €10k.

VATMOSS and Brexit

The proposed rule which would permit domestic VAT rules to apply to traders under the €10,000 threshold would effectively remove all UK microbusinesses – the ones who were forced to register for VAT solely to comply with VATMOSS requirements – from further VAT obligations.

However, that simplification is not proposed to come into effect until 2018.

UK traders continuing to sell into Europe after Brexit will be required to register as a non-union member, no different from, say, an Australian or American trader.

For more on why Brexit is in fact the worst thing that could have happened where VATMOSS is concerned, visit the EU VAT Action campaign’s update page.

Two years ago a handful of self-employed women objecting were told this was a done deal, nothing could be changed etc. @euvataction followed https://t.co/IgVNhkvJRM

— Juliet E McKenna (@JulietEMcKenna) December 1, 2016

Huge thanks to everyone who supported @euvataction with tweets, letters, representations to MPs & MEPs to highlight the issues with #VATMOSS

— Juliet E McKenna (@JulietEMcKenna) December 1, 2016

Tremendous thanks to @vickyford @catherinemep @AnnelieseDodds & their teams & colleagues for all their support for @euvataction on #VATMOSS

— Juliet E McKenna (@JulietEMcKenna) December 1, 2016